-

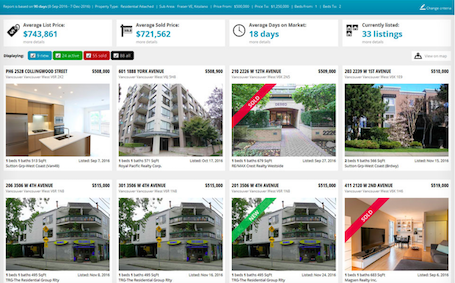

Generate a CUSTOM Market Insight Report to find out!

-

Get details on:

Recent sold prices

Average asking prices

How fast are homes selling

What to consider BEFORE buying

Buying a home is an investment in your future. Given its importance, knowledge is

key to making the right purchase. Take a look at these tidbits of information before you

dive into the buying process.

THE UPFRONT COSTS OF BUYING

|

DOWN PAYMENT This is paid once and typically represents 5-20% of the purchases price. |

|||

|

HOME INSPECTION & APPRAISAL FEES This gives you more information on the property during subject removal. |

|||

|

INSURANCE COSTS Property insurance, mortgage loan insurance, etc. |

|||

|

PROPERTY TRANSFER TAX This ranges from 1.0-3.0%, depending on the property cost. |

|||

|

LEGAL & NOTARY FEES These are required during property completion in order for the property to be registered in your name. |

|||

|

POTENTIAL REPAIRS & RENOVATIONS Any upgrades or fixes you will be making immediately after moving in. |

|||

|

|

MOVING COSTS This includes packing materials plus hired professional movers. |

|||

|

GOODS & SERVICES TAX (GST) |

IMPORTANT DOCUMENTS FOR YOUR MORTGAGE BROKER

- Contact information for your employer & your employment history

- Proof of address & your address history

- Government-issued photo IDs with your current address

- Proof of income for your mortgage application

- Proof of down payment, including the amount & source

- Proof of savings & investments

- Details of current debts & other financial obligations